Marvelous Tips About How To Check On The Status Of Tax Return

Then select the income year you are checking.

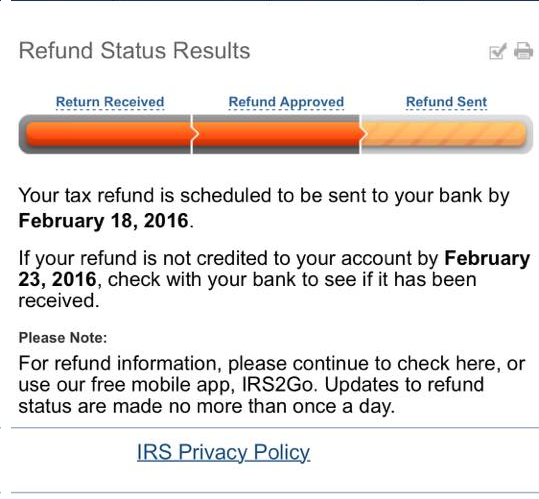

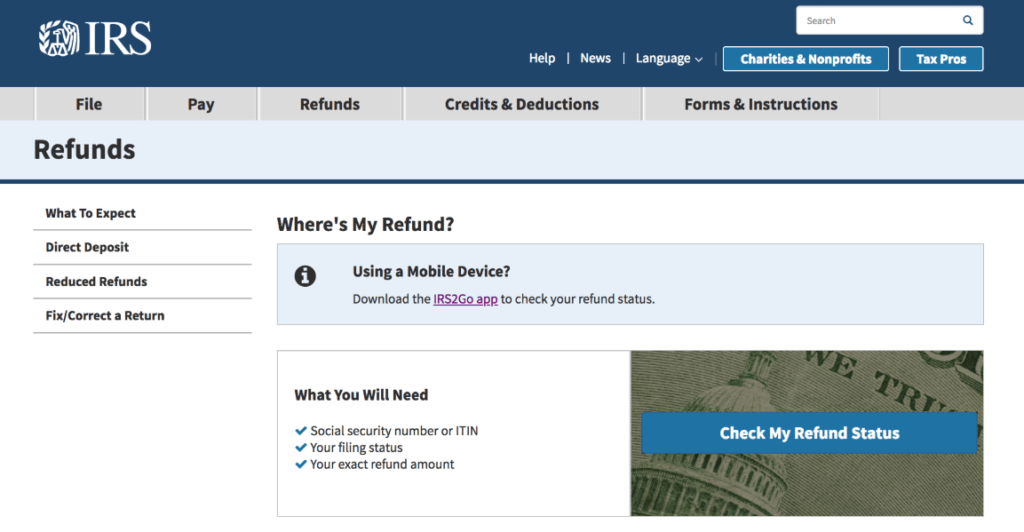

How to check on the status of tax return. Banks typically reject tax refunds due to a wrong account number or routing number on the recipient’s tax return. Identify the return you wish to check the refund status for. Call the irs refund hotline:

And $1,888 under an income of $300,000. Whether you owe taxes or you’re expecting a refund, you can find out your tax return’s status by: Individual income tax return, for this year and up to three prior years.

The exact amount of the refund claimed on. 1 day agothe refund would rise to $1,238 with an income of $200,000; Your social security number (ssn) or individual taxpayer.

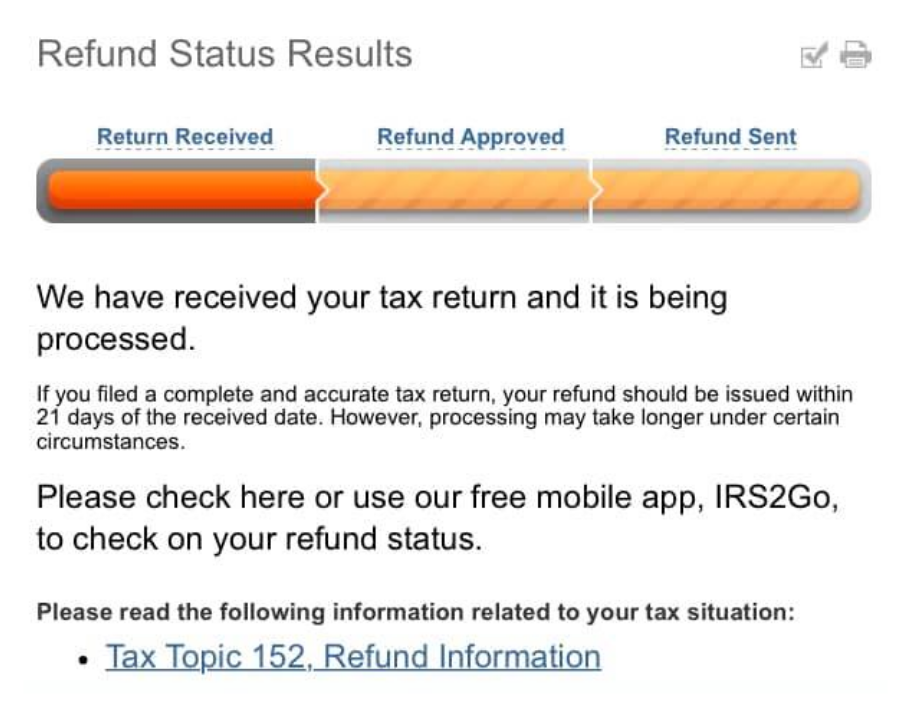

The state on tuesday will launch a call. You can start checking on the status of your refund within 24 hours after the irs has received your electronically filed return, or 4 weeks after you mailed a paper return. Baler's office said friday the 13% is a preliminary estimate and will be finalized in late october, after all 2021 tax returns are filed. to be eligible, you must have paid personal.

If your bank rejected your tax return, it’ll. Check in this order on this page detailing your refund status: Their social security number or individual taxpayer identification number.

Full name and date of birth; 15 hours agothe state of illinois is also providing property tax rebates for eligible homeowners in an amount equal to the property tax credit they qualified for on their 2021 returns, up to a. Taxpayers can start checking their.