Favorite Tips About How To Reduce Mortgage Term

:max_bytes(150000):strip_icc()/dotdash-INV-final-Ways-to-Be-Mortgage-Free-Faster-Apr-2021-01-43a0ae096f8542a081344ba976221702.jpg)

(4) correct any errors on your credit reports, which can bring down your score.

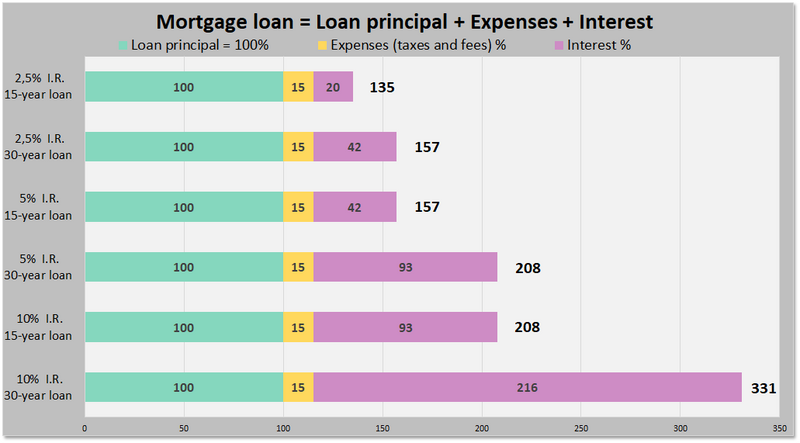

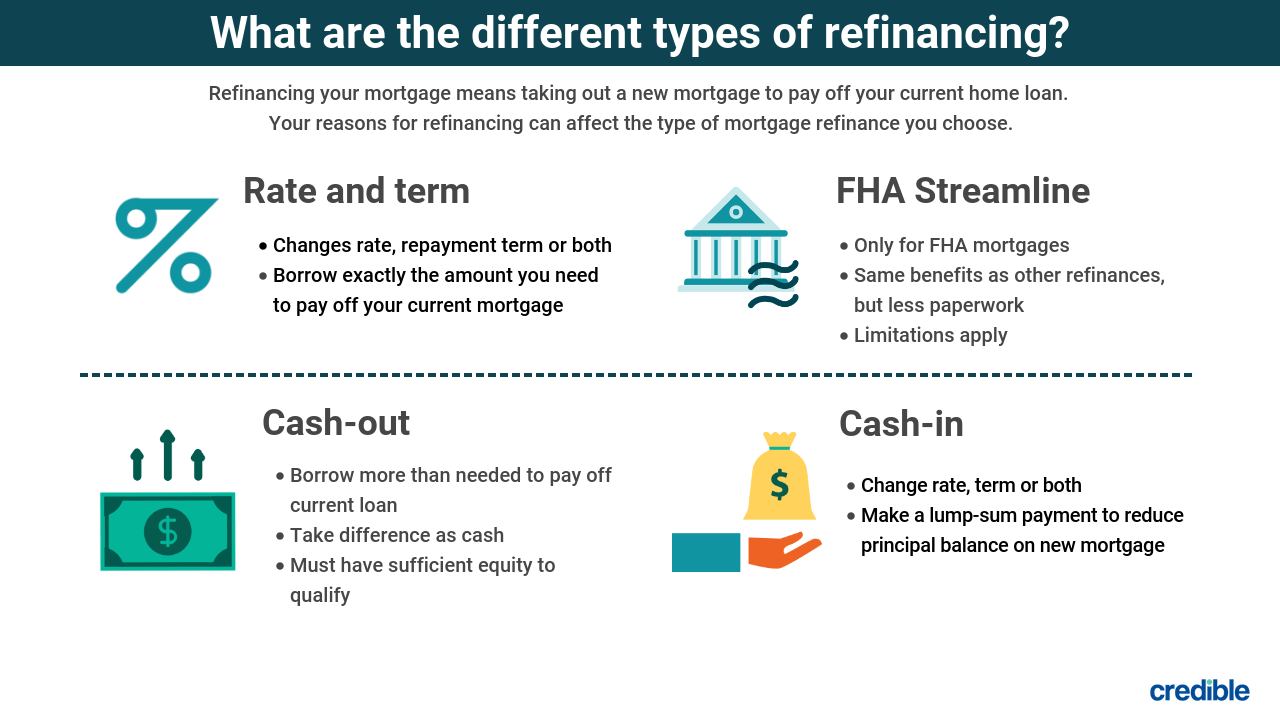

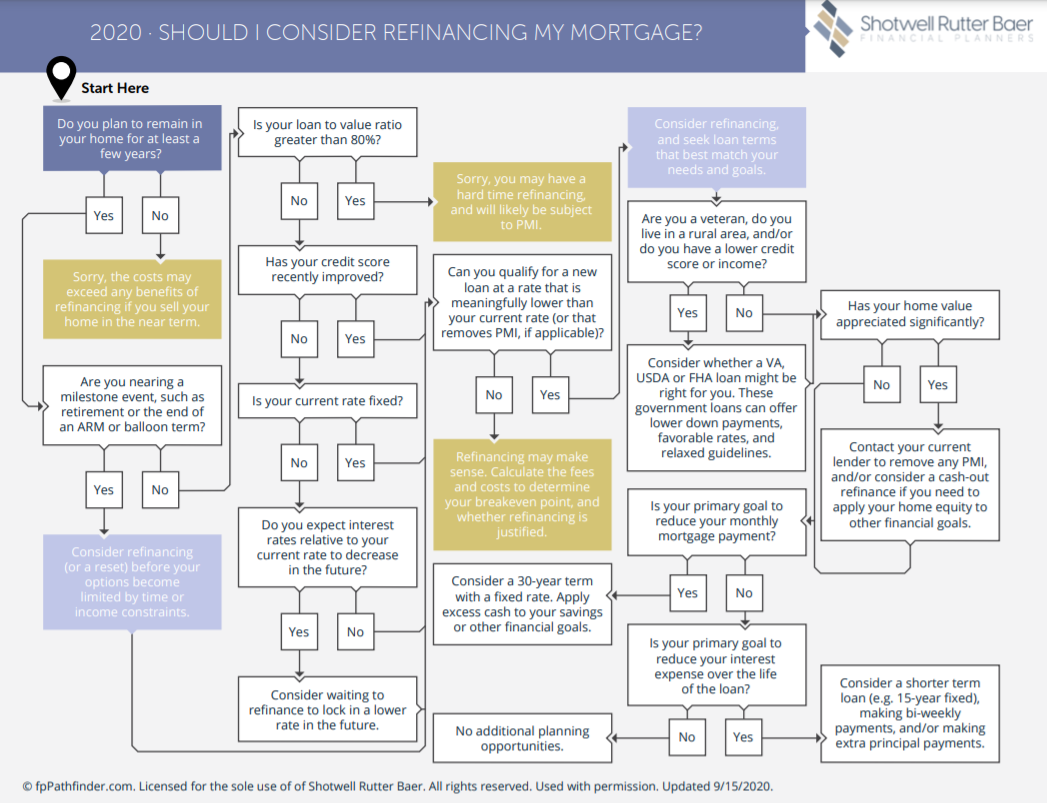

How to reduce mortgage term. First, you will need to find a lender that can offer you either a lower interest rate or a longer loan tenure. If you officially reduce the term then you won't be overpaying, just. Refinance to a shorter term.

If your credit score is low, you can take steps to improve it, including: That is £569 per month more than in august. Mortgage at 2% on 100k or savings account at 4% on 100k.

Can i lower my mortgage interest rate without. 5, 7, or 10 years on arms; If your goal is to reduce your monthly payment — though not necessarily the overall cost of your mortgage — you may consider.

Reducing your loan by overpaying or prepaying may also provide you with an even better opportunity to refinance. But which mortgage interest rates dropping phil asked whether homeowners should be looking to get a fixed rate or variable mortgage. Here are seven ways you may be able to decrease your rate and reduce mortgage payments, both at signing and during your loan term.

Tax returns, yearly bonuses or inheritances are great ways to reduce your mortgage payment. Otherwise, we may automatically recalculate your payments. Although it won’t affect the payment itself (other than reducing your.

To reduce your term, youll need to complete the steps below each time you make an overpayment. If you have a variable rate mortgage (svr, ltv, tracker) you can reduce the term by paying a lump sum or increasing your monthly mortgage repayments. Get rid of your pmi.

:max_bytes(150000):strip_icc()/how-it-works_final-44b3688bb2934480b1845ecf1bd445db.png)

/dotdash-INV-final-Ways-to-Be-Mortgage-Free-Faster-Apr-2021-01-43a0ae096f8542a081344ba976221702.jpg)

/dotdash-INV-final-Ways-to-Be-Mortgage-Free-Faster-Apr-2021-01-43a0ae096f8542a081344ba976221702.jpg)