Fun Info About How To Sell A Call Option

To do so, tap the magnifying glass in the top right corner of your home screen.

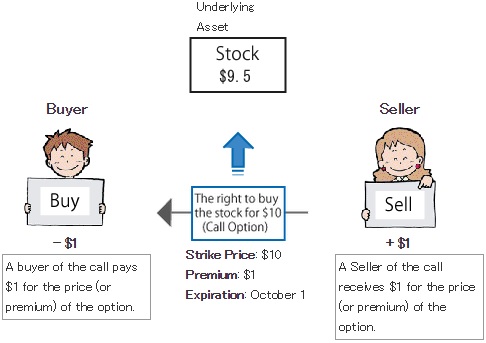

How to sell a call option. You sell a call option with a strike price near your. Calls give the buyer the right, but not the obligation, to buy the underlying asset at the strike price. Call options are a type of option that increases in value when a stock rises.

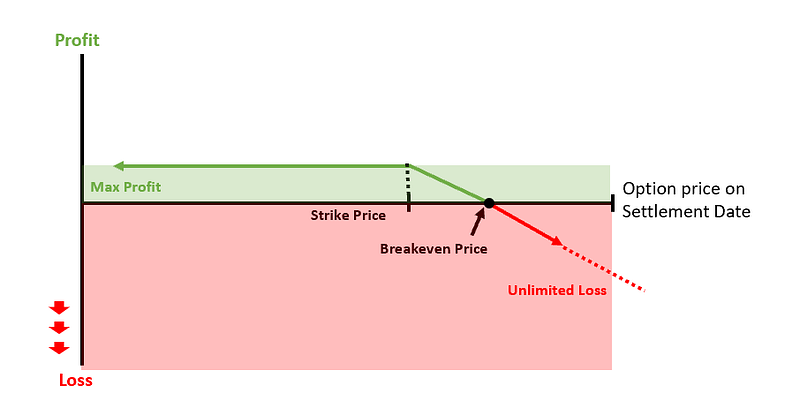

This only matters if the buyer exercises the contract. I will walk you through the sell option method in etrade. A chart explaining how the payoff work.

There are two main types of written call options, naked and covered. Once you’ve picked a stock, a new page. Find the stock you’d like to sell a call option for.

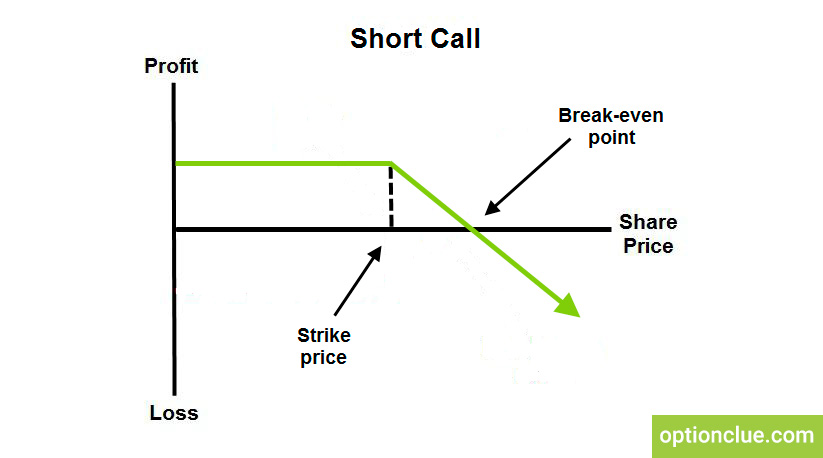

Between $20 and $22, the call seller still earns some of the premium, but not all. Many people don’t understand that you can actually sell option contracts without having the stock, or without owning the other option side of the trade.selli. Payoffs from a short call position.

As the seller of a call option, you believe the underlying stock will stay the same or fall in value before expiry. You are selling the call (you’re short, buyer is long) to an options buyer because your believe that the price of the stock is going to fall, while the buyer believes it is going up. The covered call option method is used to sell the call option when the seller posses ownership of the underlying asset or security and he has been holding this position for a long time.

How to sell call options selling an option is a simple trade. Another way to sell a call option is to write your own. Selling a call is not as easy as it might seem due to order types (e.g., open or close).

:max_bytes(150000):strip_icc()/Clipboard01-617b9d39bcc744d691fc612f569587e0.jpg)

![How To Sell A Call Option - [Option Trading Basics] - Tradersfly](https://tradersfly.com/wp-content/uploads/2019/06/2017-07-27-selling-call-options-single-296.jpg)

:max_bytes(150000):strip_icc()/NakedCallWriting-AHighRiskOptionsStrategy2_2-aab223af50cc44ba9a0f874609356225.png)

![How To Sell A Call Option - [Option Trading Basics] - Youtube](https://i.ytimg.com/vi/SAgkEWTGTDw/maxresdefault.jpg)

:max_bytes(150000):strip_icc()/CoveredCall-943af7ec4a354a05aaeaac1d494e160a.png)

/Clipboard01-617b9d39bcc744d691fc612f569587e0.jpg)

![How To Sell A Put Option - [Option Trading Basics] - Tradersfly](https://tradersfly.com/wp-content/uploads/2019/06/2017-07-27-selling-put-options-single-263.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Call_Option_Definition_Apr_2020-01-a13f080e7f224c09983babf4f720cd4f.jpg)